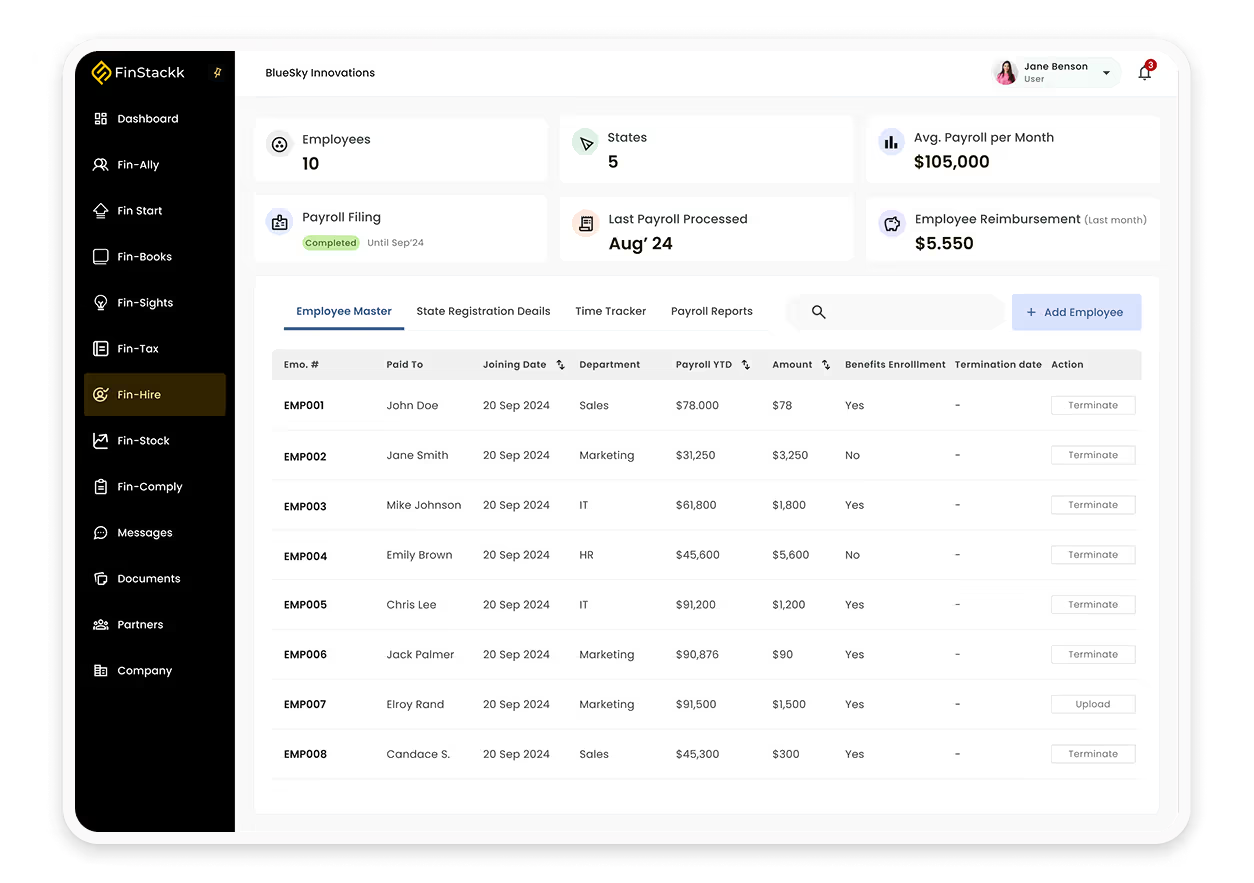

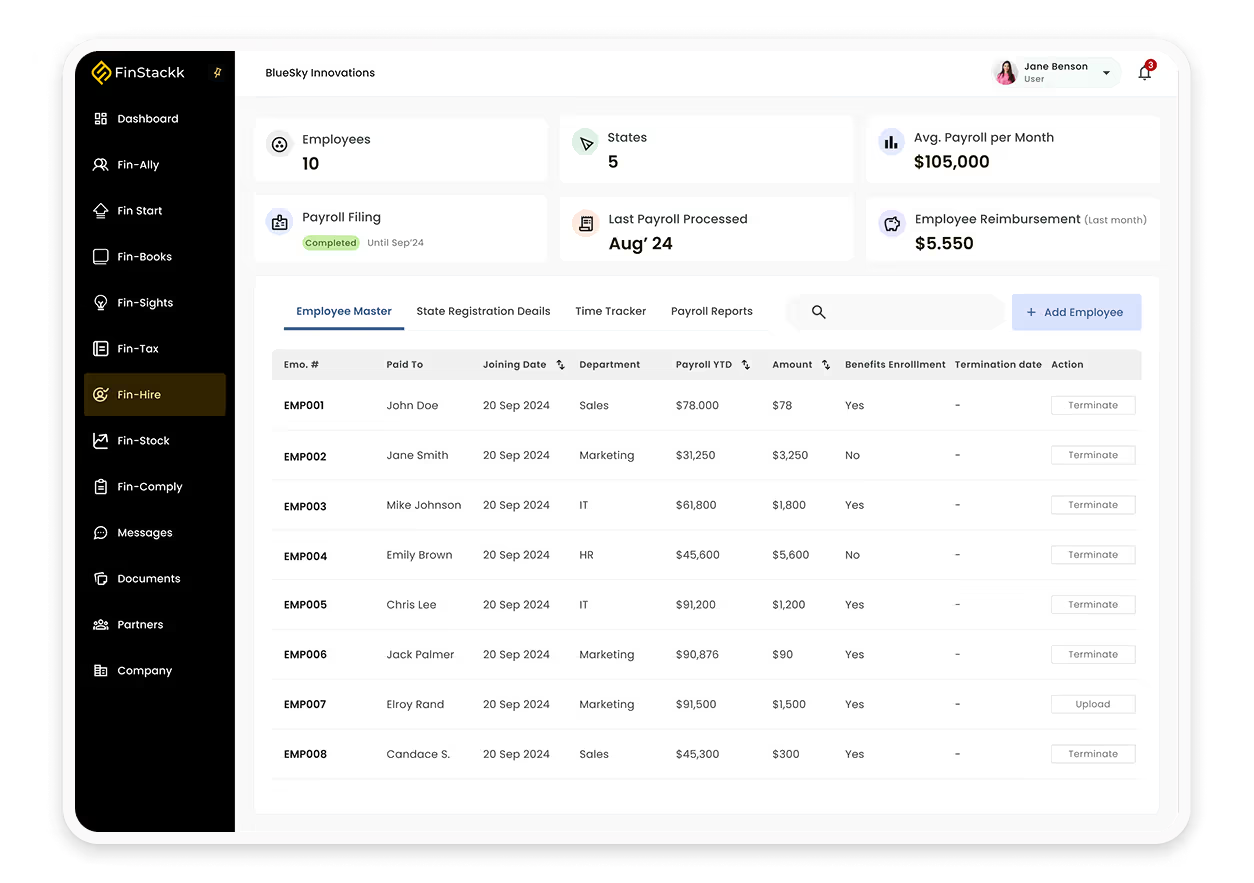

The payroll manager for your business

Registrations | Onboarding | Payroll processing | Benefits | Reimbursements | Compliances

Registrations | Onboarding | Payroll processing | Benefits | Reimbursements | Compliances

HR Activities:

Payroll Processing:

It's essential to distinguish between employees and independent contractors, as this impacts tax withholding and liability. Classification is based on factors like behavioral control, financial control, and the nature of the relationship.

Federal income tax, Social Security tax, Medicare tax, and, in some cases, state and local taxes are commonly withheld from employee paychecks.

Payroll frequency can vary (weekly, biweekly, semi-monthly, or monthly). Choose a schedule that aligns with your business needs and complies with state laws.

Keep records of:

Note: Retain these records for at least three years.

Penalties may include:

A W-2 form summarizes an employee's annual wages and tax withholdings. Employers must issue it by January 31st of the following year.

Stay informed on state-specific laws regarding:

We manage payroll tax filings through a payroll processor to ensure accurate and timely submissions. We also handle manual filings when needed for corrections or unique cases.

We partner with a third-party processor to leverage their technology and expertise, ensuring efficient and accurate payroll management.

We provide personalized service and flexible solutions, tailored specifically to the unique needs of each business.

We bridge the gap for complex payroll issues, such as:

Yes, we assist with benefits administration, including: